Wireless telecommunications provider U.S. Cellular (NYSE:USM) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 6.2% year on year to $891 million. Its GAAP profit of $0.21 per share was 38.6% below analysts’ consensus estimates.

Is now the time to buy U.S. Cellular? Find out by accessing our full research report, it’s free.

U.S. Cellular (USM) Q1 CY2025 Highlights:

- Revenue: $891 million vs analyst estimates of $919.4 million (6.2% year-on-year decline, 3.1% miss)

- EPS (GAAP): $0.21 vs analyst expectations of $0.34 (38.6% miss)

- Adjusted EBITDA: $254 million vs analyst estimates of $256.6 million (28.5% margin, 1% miss)

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 7.4% in the same quarter last year

- Market Capitalization: $5.86 billion

"In the first quarter, we continued to work towards executing on our 2025 priorities which include successfully closing on the previously announced sale of the wireless business, while remaining focused on investing in a strong customer experience and operating our business efficiently," said Laurent Therivel, UScellular President and CEO.

Company Overview

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, US Cellular (NYSE:USM) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.71 billion in revenue over the past 12 months, U.S. Cellular is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

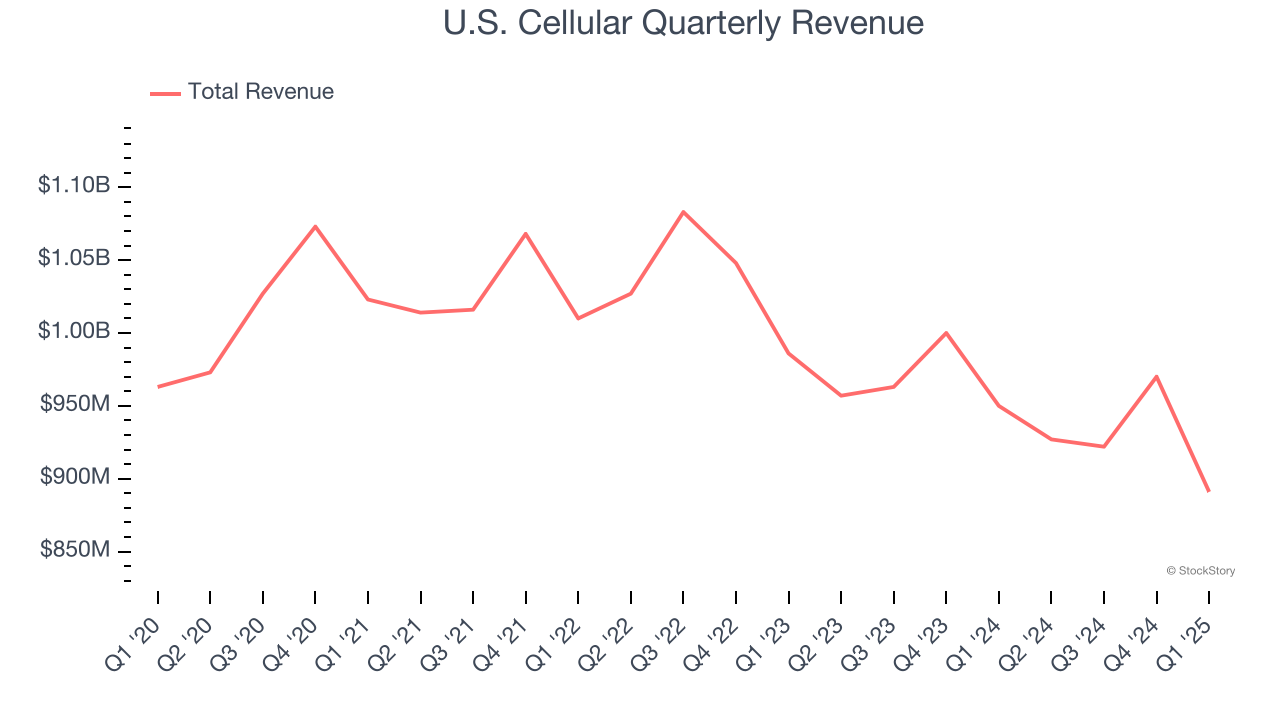

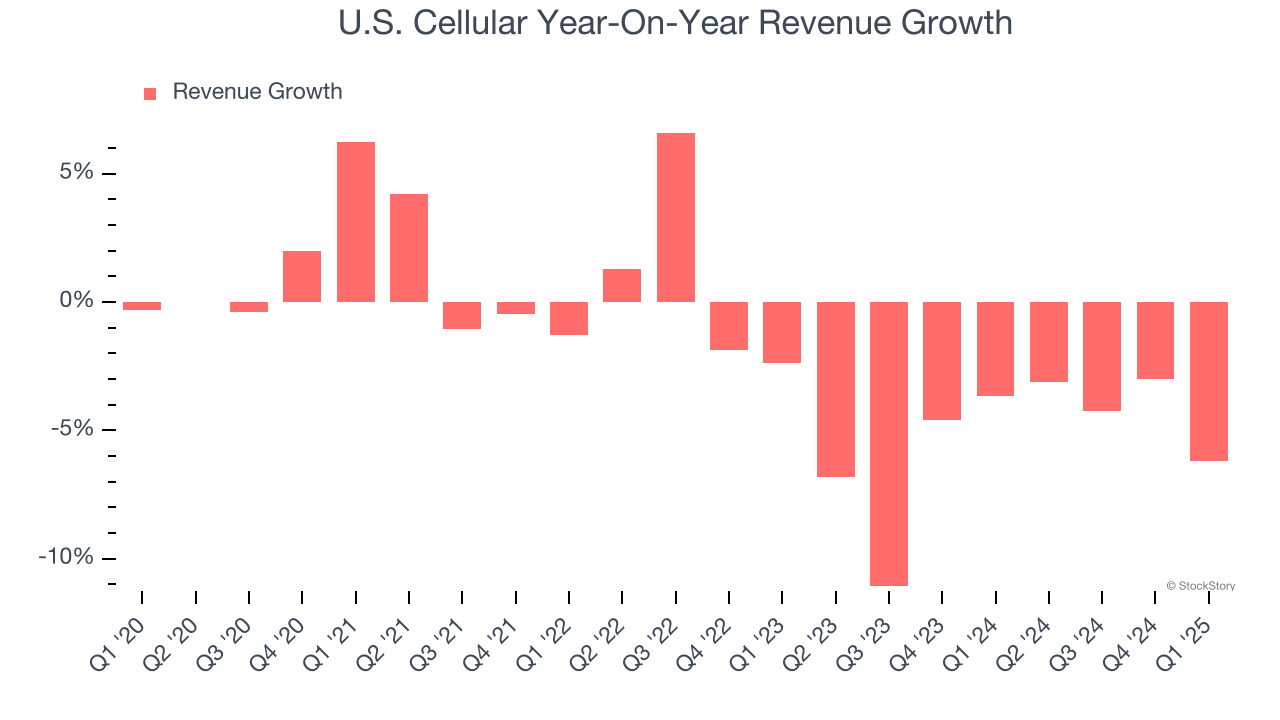

As you can see below, U.S. Cellular struggled to generate demand over the last five years. Its sales dropped by 1.6% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. U.S. Cellular’s recent performance shows its demand remained suppressed as its revenue has declined by 5.4% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Services revenue. Over the last two years, U.S. Cellular’s Services revenue revenue (telecom services) averaged 2.1% year-on-year declines. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, U.S. Cellular missed Wall Street’s estimates and reported a rather uninspiring 6.2% year-on-year revenue decline, generating $891 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

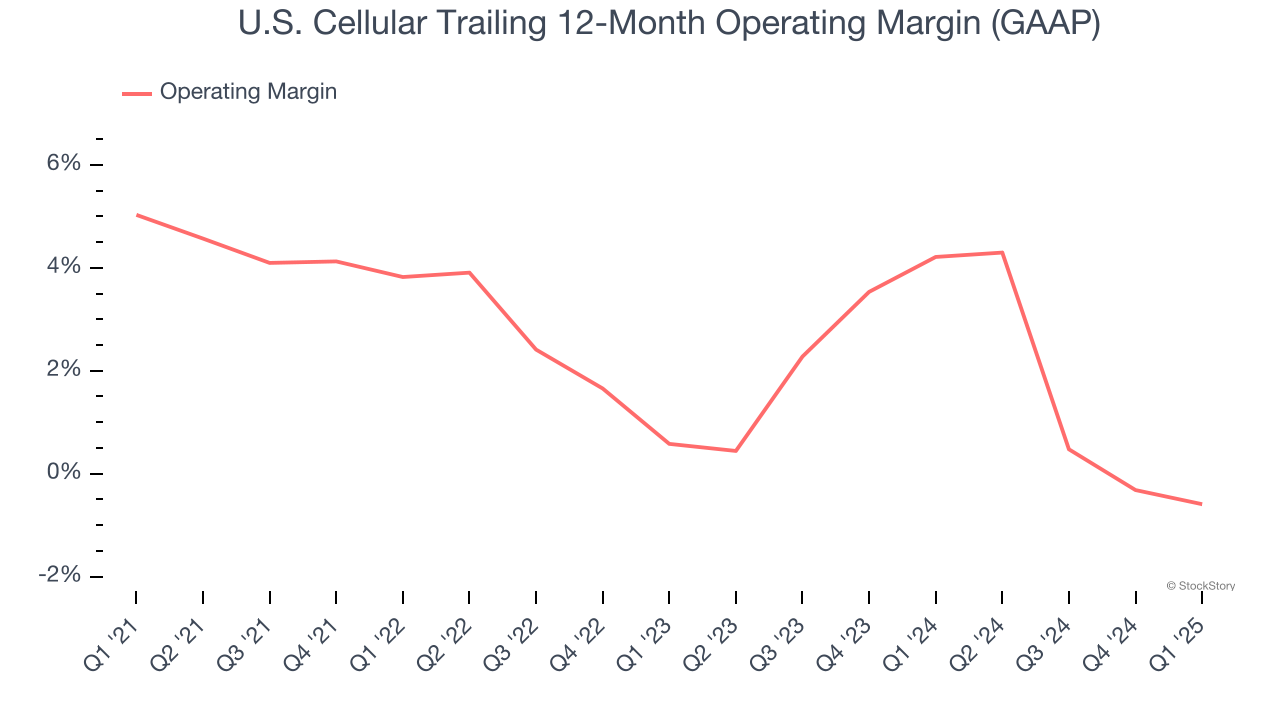

U.S. Cellular was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.6% was weak for a business services business.

Looking at the trend in its profitability, U.S. Cellular’s operating margin decreased by 5.6 percentage points over the last five years. U.S. Cellular’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q1, U.S. Cellular generated an operating profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

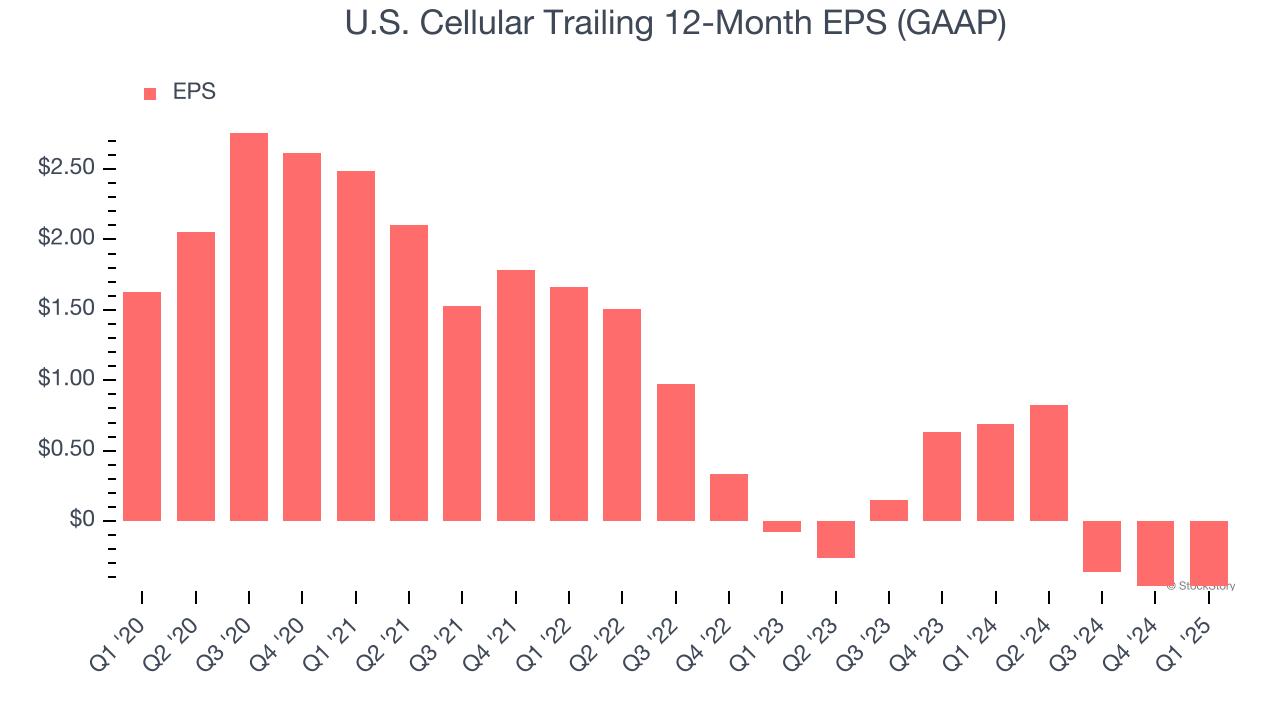

Sadly for U.S. Cellular, its EPS declined by 17.9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into U.S. Cellular’s earnings to better understand the drivers of its performance. As we mentioned earlier, U.S. Cellular’s operating margin was flat this quarter but declined by 5.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, U.S. Cellular reported EPS at $0.21, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast U.S. Cellular’s full-year EPS of negative $0.46 will flip to positive $1.18.

Key Takeaways from U.S. Cellular’s Q1 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.2% to $67.85 immediately after reporting.

U.S. Cellular’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.