Home healthcare provider Addus HomeCare (NASDAQ:ADUS) missed Wall Street’s revenue expectations in Q1 CY2025, but sales rose 20.3% year on year to $337.7 million. Its non-GAAP profit of $1.42 per share was 6.5% above analysts’ consensus estimates.

Is now the time to buy Addus HomeCare? Find out by accessing our full research report, it’s free.

Addus HomeCare (ADUS) Q1 CY2025 Highlights:

- Revenue: $337.7 million vs analyst estimates of $339.9 million (20.3% year-on-year growth, 0.6% miss)

- Adjusted EPS: $1.42 vs analyst estimates of $1.33 (6.5% beat)

- Adjusted EBITDA: $40.57 million vs analyst estimates of $39.97 million (12% margin, 1.5% beat)

- Operating Margin: 9%, in line with the same quarter last year

- Sales Volumes rose 33.8% year on year (-1.7% in the same quarter last year)

- Market Capitalization: $1.91 billion

Commenting on the results, Dirk Allison, Chairman and Chief Executive Officer, said, “Addus had a strong start to 2025, delivering a solid financial and operating performance as we continue to see solid demand for our home-based care services across the continuum. Revenue for the first quarter of 2025 was up 20.3% and adjusted EBITDA increased 25.1% over the same period last year. These results reflect solid organic growth and include the first full quarter of the personal care operations of Gentiva, which we acquired on December 2, 2024.

Company Overview

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ:ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

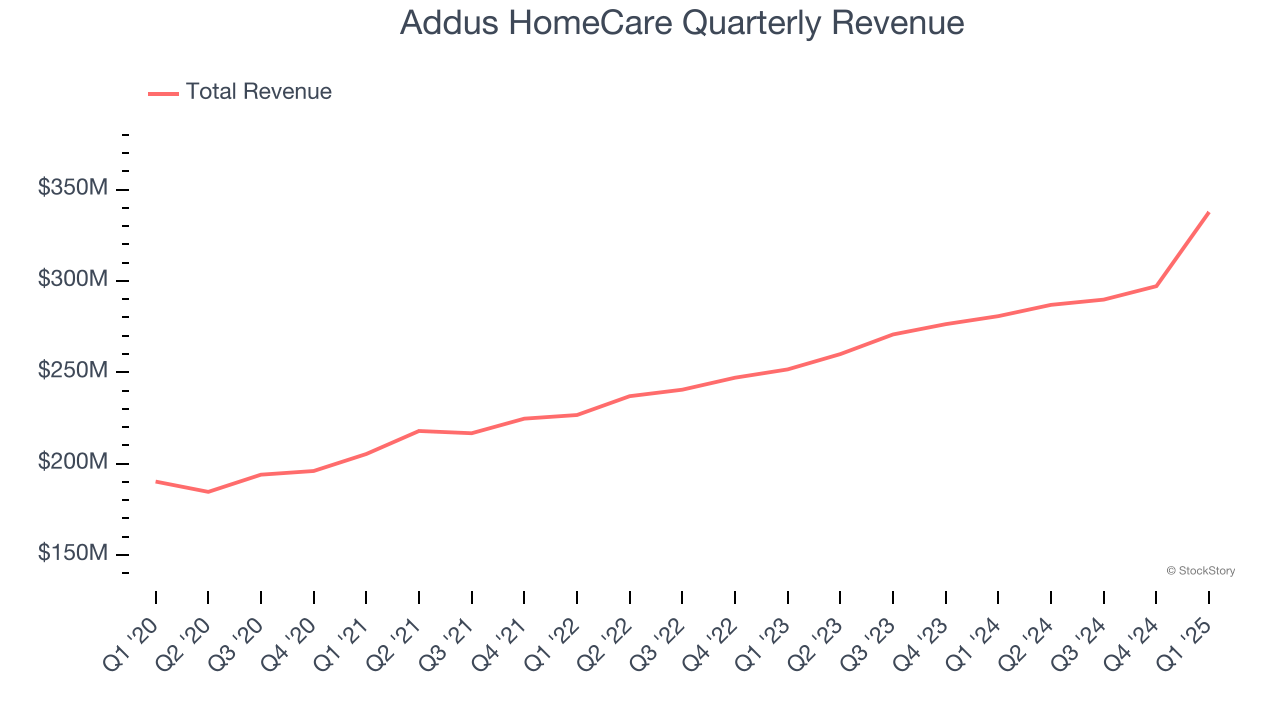

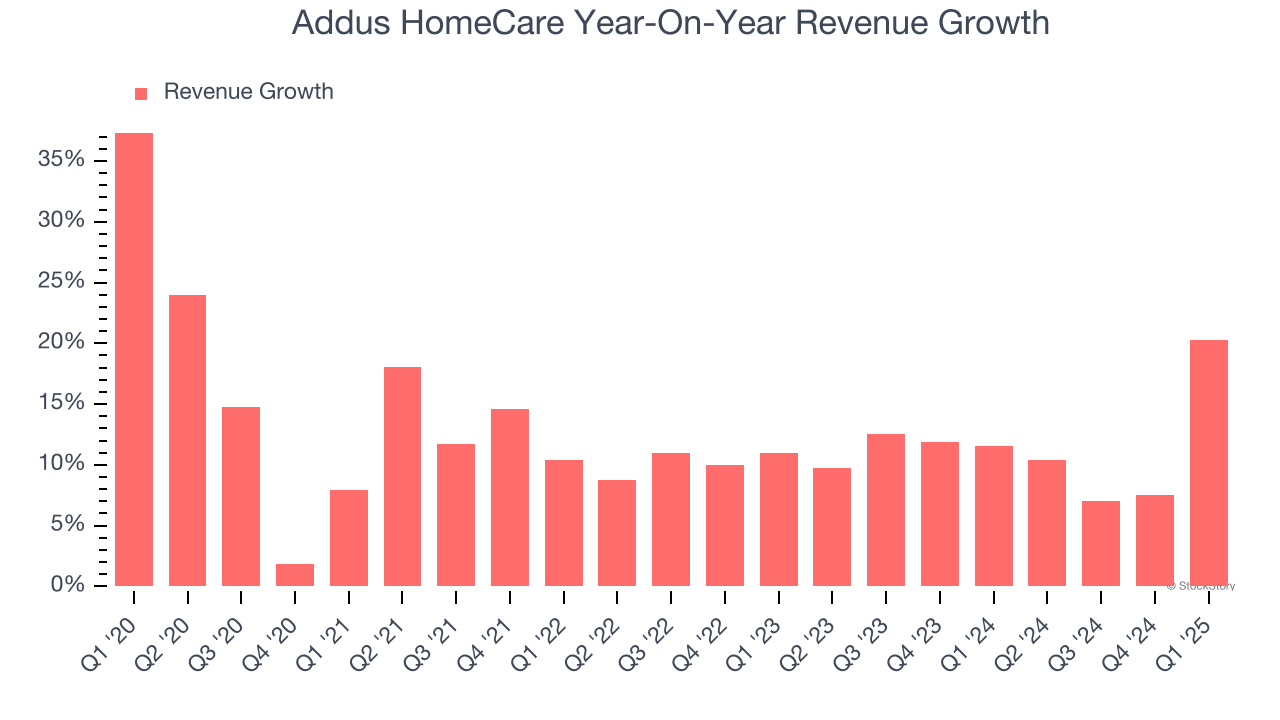

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Addus HomeCare’s 11.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Addus HomeCare’s annualized revenue growth of 11.4% over the last two years aligns with its five-year trend, suggesting its demand was stable.

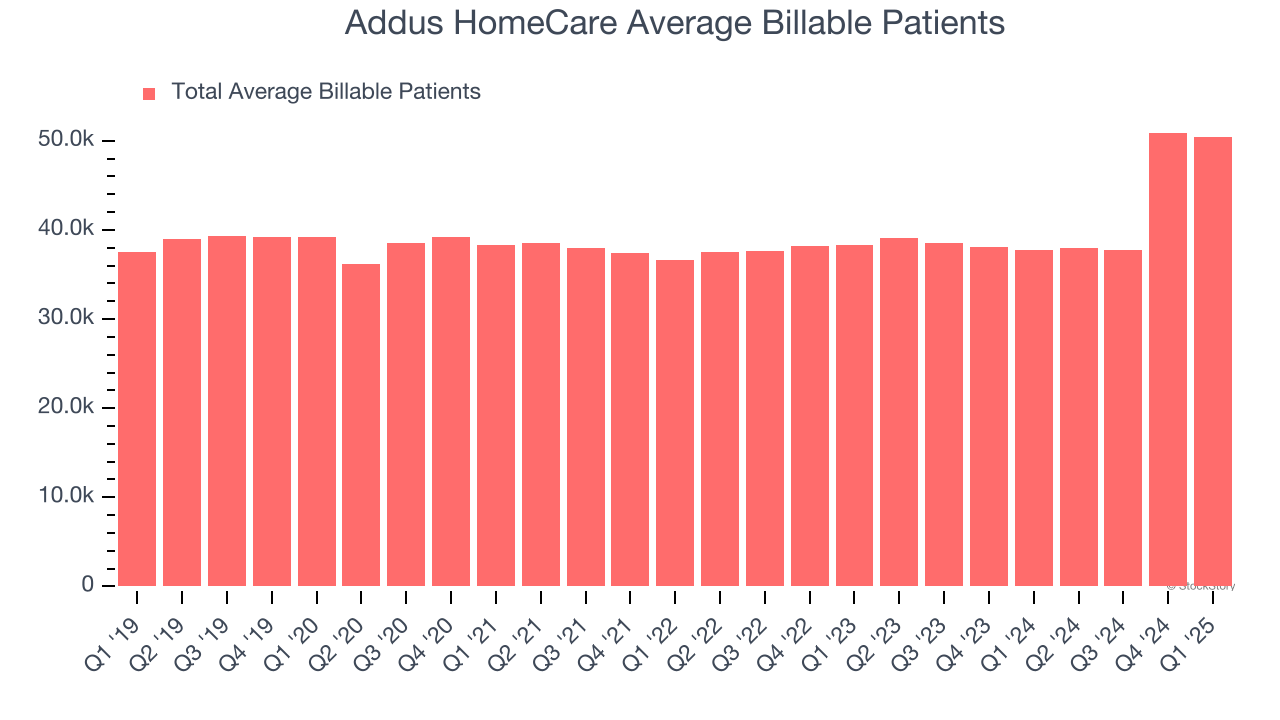

We can dig further into the company’s revenue dynamics by analyzing its number of average billable patients, which reached 50,478 in the latest quarter. Over the last two years, Addus HomeCare’s average billable patients averaged 8.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Addus HomeCare generated an excellent 20.3% year-on-year revenue growth rate, but its $337.7 million of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 17.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

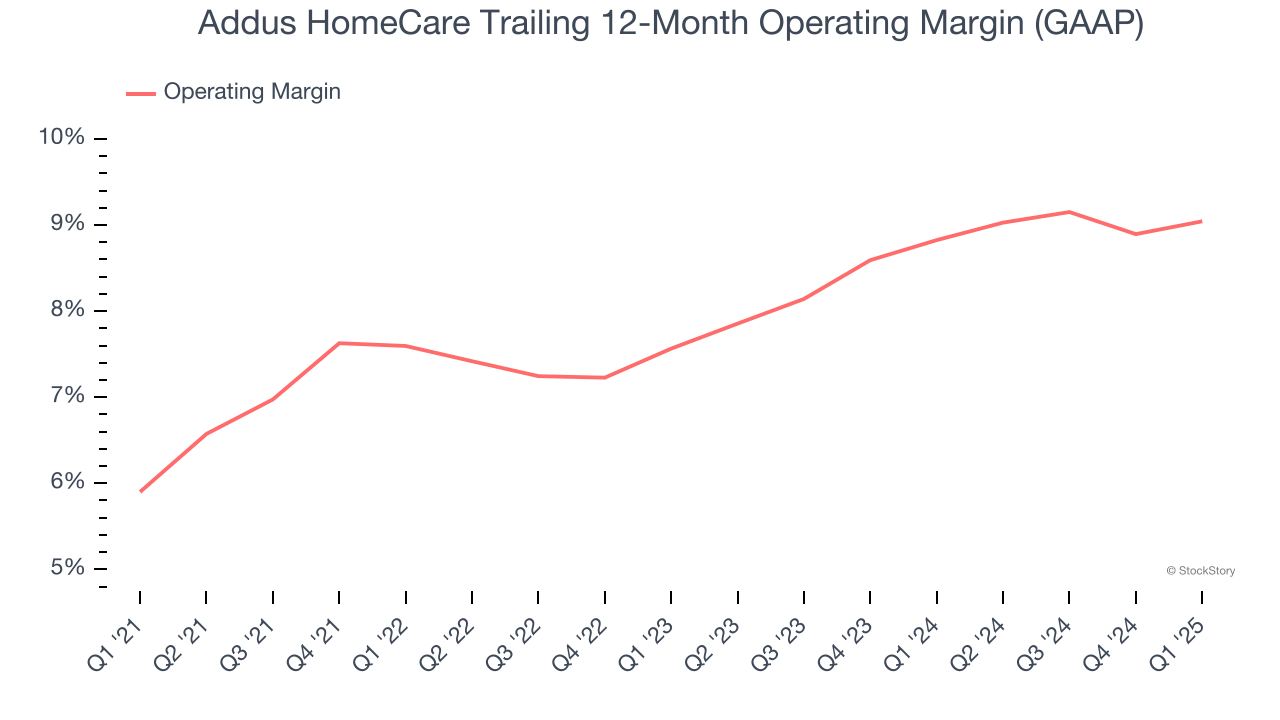

Operating Margin

Addus HomeCare was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.9% was weak for a healthcare business.

On the plus side, Addus HomeCare’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.5 percentage points on a two-year basis.

In Q1, Addus HomeCare generated an operating profit margin of 9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

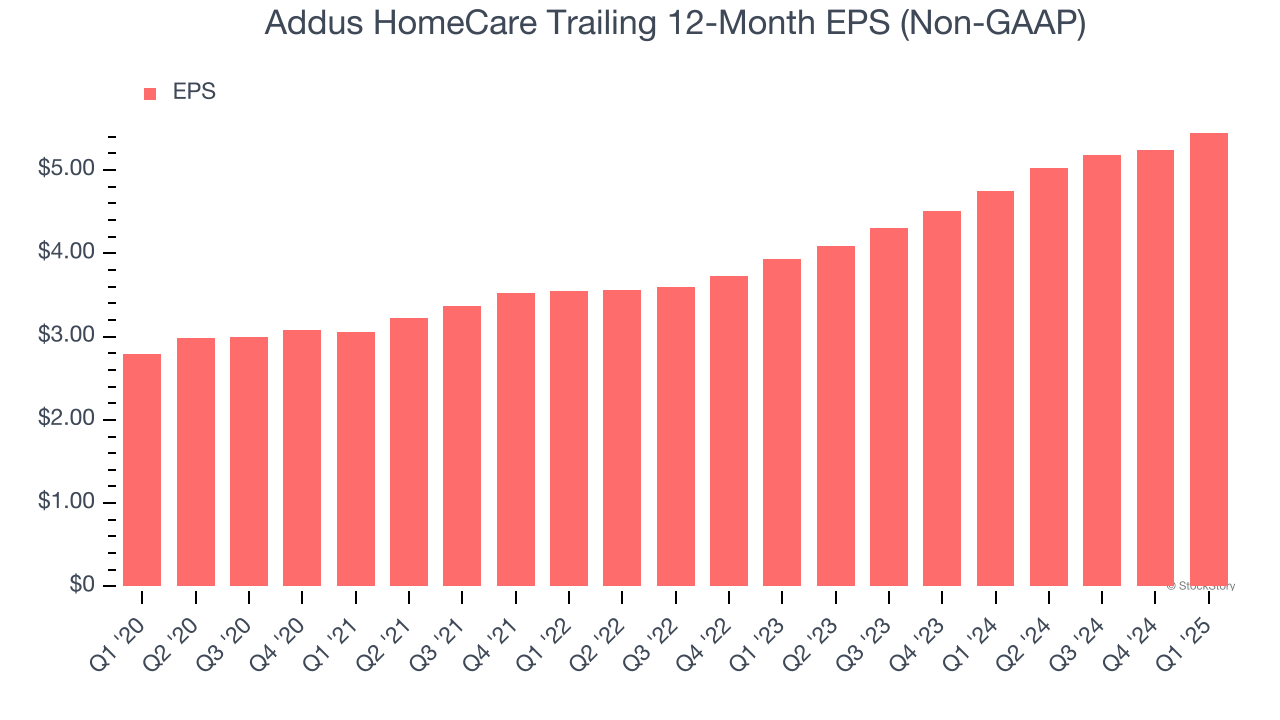

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Addus HomeCare’s EPS grew at a spectacular 14.3% compounded annual growth rate over the last five years, higher than its 11.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Addus HomeCare’s earnings can give us a better understanding of its performance. As we mentioned earlier, Addus HomeCare’s operating margin was flat this quarter but expanded by 3.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Addus HomeCare reported EPS at $1.42, up from $1.21 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Addus HomeCare’s full-year EPS of $5.45 to grow 13.7%.

Key Takeaways from Addus HomeCare’s Q1 Results

It was good to see Addus HomeCare narrowly top analysts’ sales volume expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 2.3% to $106.80 immediately after reporting.

So do we think Addus HomeCare is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.