Cross border payment processor Flywire (NASDAQ: FLYW) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 17% year on year to $133.5 million. On the other hand, next quarter’s revenue guidance of $119.9 million was less impressive, coming in 1.5% below analysts’ estimates. Its GAAP loss of $0.03 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Flywire? Find out by accessing our full research report, it’s free.

Flywire (FLYW) Q1 CY2025 Highlights:

- Revenue: $133.5 million vs analyst estimates of $128.5 million (17% year-on-year growth, 3.9% beat)

- EPS (GAAP): -$0.03 vs analyst estimates of $0.01 (significant miss)

- Adjusted EBITDA: $21.6 million vs analyst estimates of $19.95 million (16.2% margin, 8.3% beat)

- Revenue Guidance for Q2 CY2025 is $119.9 million at the midpoint, below analyst estimates of $121.7 million

- Operating Margin: -8.2%, down from -5.2% in the same quarter last year

- Free Cash Flow was -$80.39 million compared to -$42.3 million in the previous quarter

- Billings: $133 million at quarter end

- Market Capitalization: $1.18 billion

"We are pleased with our 2025 first quarter results, as we signed more than 200 new clients, led by our Travel and Education verticals, and exceeded the high end of our FX Neutral Revenue Guidance, while expanding Adjusted EBITDA margins above our guidance mid-point," said Mike Massaro, CEO of Flywire.

Company Overview

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

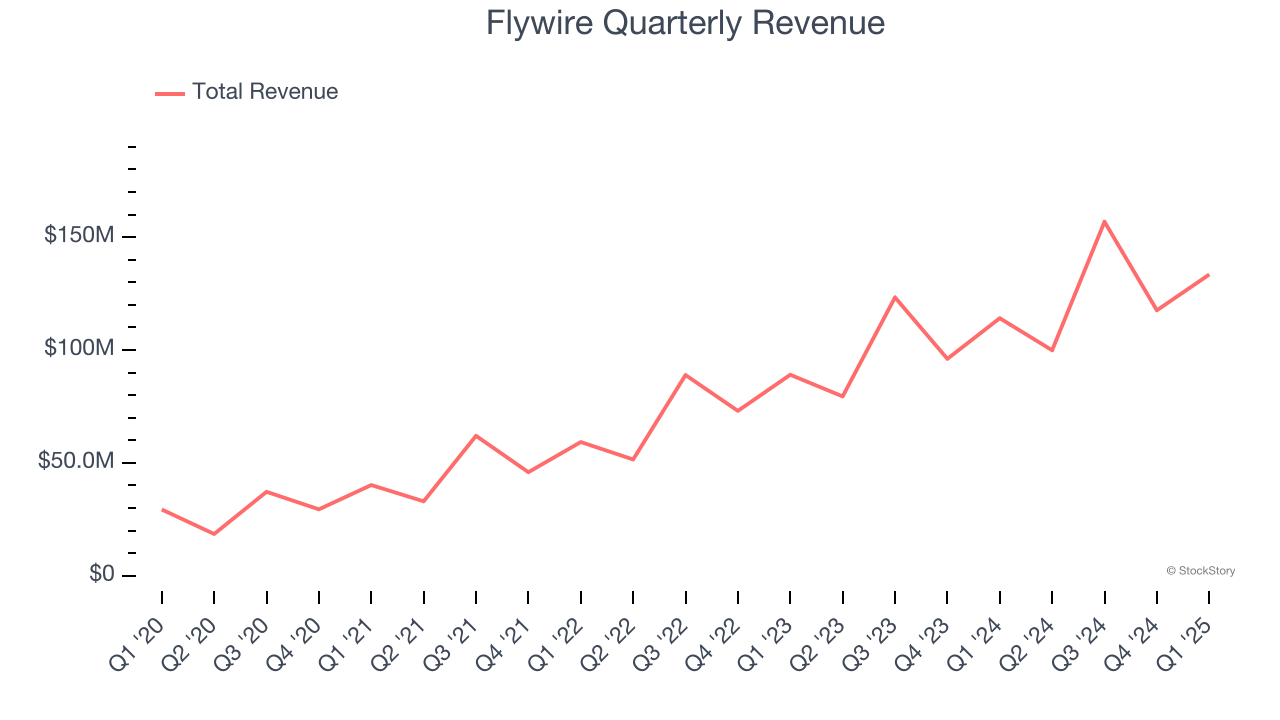

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Flywire’s sales grew at an exceptional 36.4% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Flywire reported year-on-year revenue growth of 17%, and its $133.5 million of revenue exceeded Wall Street’s estimates by 3.9%. Company management is currently guiding for a 20% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.8% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and indicates the market is forecasting success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Flywire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Flywire’s Q1 Results

We were impressed by how significantly Flywire blew past analysts’ revenue and EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter missed. Still, this print had some key positives. The stock traded up 13.3% to $11.39 immediately after reporting.

So do we think Flywire is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.