NVIDIA Corp (NVDA)

185.41

+13.53 (7.87%)

NASDAQ · Last Trade: Feb 7th, 4:14 AM EST

Detailed Quote

| Previous Close | 171.88 |

|---|---|

| Open | 176.69 |

| Bid | 185.18 |

| Ask | 185.20 |

| Day's Range | 174.60 - 187.00 |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 231,346,242 |

| Market Cap | 4.51T |

| PE Ratio (TTM) | 45.89 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 172,530,855 |

Chart

About NVIDIA Corp (NVDA)

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

Investing doesn't have to be complicated.

Via The Motley Fool · February 7, 2026

Nvidia was propelled to its current highs by the development of AI, but is it still one of the best ways to play it?

Via The Motley Fool · February 6, 2026

Agentic AI could bring about a major shift in the data center.

Via The Motley Fool · February 6, 2026

Nearly all Magnificent 7 members have reported Q4 2025 results, with Nvidia scheduled to finish the cycle on February 25, 2026.

Via Talk Markets · February 6, 2026

AI has already made Nvidia into a $4.3 trillion company. Who's next to join the trillion-dollar-club on the back of the AI trend?

Via The Motley Fool · February 6, 2026

These companies will help turn a little money into a lot.

Via The Motley Fool · February 6, 2026

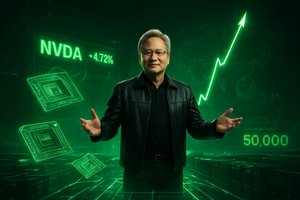

AI chip leaders helped the Dow clear the historic 50,000 mark as risk appetite returned across tech and crypto, today, Feb. 6, 2026.

Via The Motley Fool · February 6, 2026

In a X post, Black said that he’s bullish on big technology names despite the market concern over massive capital expenditures planned for 2026, outlining three major reasons for his stance.

Via Stocktwits · February 6, 2026

In a dramatic reversal of fortune for the digital asset sector, MicroStrategy Inc. (NASDAQ: MSTR) spearheaded a massive rally on the Nasdaq today, February 6, 2026, with its stock price surging 25%. The leap comes as Bitcoin (BTC) staged a historic "V-shaped" recovery, rebounding from a harrowing intraday low of

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

SEATTLE — Shares of Amazon.com, Inc. (NASDAQ:AMZN) plummeted more than 5% in early trading on Friday, February 6, 2026, following a fourth-quarter earnings report that showcased record-breaking revenue but also unveiled a staggering $200 billion capital expenditure plan for the coming year. While the tech giant beat analyst expectations

Via MarketMinute · February 6, 2026

In a historic session for Wall Street, shares of Nvidia (NASDAQ:NVDA) surged more than 8% on Friday, February 6, 2026, breathing new life into the global technology trade. The rally was ignited by a high-stakes television appearance by CEO Jensen Huang, who declared that the demand for artificial intelligence

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

From climate-focused screening to sheer market breadth, IEMG and NZAC take distinct paths to global diversification.

Via The Motley Fool · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

Prediction: This Artificial Intelligence (AI) Stock Will Be Worth $5 Trillion by End of 2026fool.com

Nvidia could soar even higher as the AI market expands.

Via The Motley Fool · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026